Manba: cleanenergywire.org

Parabel GmbHTez dalillar

(2019 yil oxiridagi raqamlar; Manba: BSW Solar , BMWi , BNetzA )

Boshlanish yili: 1991 (birinchi yordam)

O'rnatilgan quyosh massivlari soni: 1,8 million

O'rnatilgan umumiy quvvat: 49 GVt

Rejalashtirilgan kengaytirish: 2030 yilda 98 GVt ( taxminiy )

Quvvat iste'moli ulushi : 8%

Chiqish: 47 TWh

Bandlik : ca. 36.000

Qo'llab-quvvatlashning o'rtacha darajasi (yangi qurilmalar): 5,18 kVt / soat (2020 yil mart)

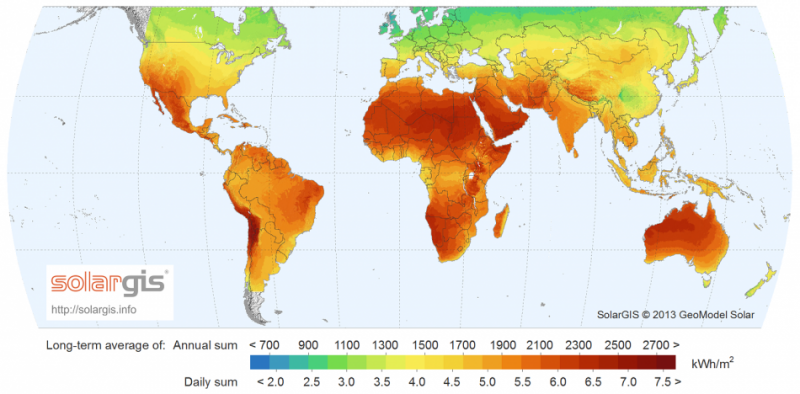

Germaniya quyosh nuri eng kam soatiga ega bo'lgan davlatlar qatorida bo'lishiga qaramay, dunyodagi eng katta quyosh energiyasini ishlab chiqaruvchilardan biri hisoblanadi. Xalqaro Energiya Agentligi (IEA) ma'lumotlariga ko'ra , 2019 yilda o'rnatilgan quvvati 49 gigavatt (GVt) bo'lgan mamlakat bir necha yillar davomida zaryadlovchidan keyin dunyoda 4-o'rinni egalladi .

Katta va markazlashtirilgan ishlab chiqaruvchilarga yo'naltirilgan an'anaviy energiya tizimlaridan farqli o'laroq, minglab quyosh batareyalari operatorlari Germaniya energiya tizimining muhim qismiga aylandi . BDEW energetika sanoat guruhiga ko'ra, 2019 yilda ular mamlakatning sof energiya iste'molining qariyb sakkiz foizini, qayta tiklanadigan energiya ulushining 43 foizini ishlab chiqargan . IEA ma'lumotlariga ko'ra , 2019 yilda birinchi marta quyosh energiyasining global ishlab chiqarishdagi ulushi ikki foizdan oshdi .

Ushbu texnologiya , ayniqsa quyoshli kunlarda , Germaniya quvvat aralashmasiga ko'proq hissa qo'shishi mumkin . Fraunhofer ISE tadqiqot instituti aniqlaganidek, 2020 yil aprel oyida u butun hafta davomida rekord darajadagi 23 foizni va kunlik deyarli 28 foizni tashkil qildi . Tushga yaqin, quyoshning intensivligi va odatda energiya iste'moli eng yuqori darajada bo'lganida, Germaniya ishlab chiqaradigan elektr energiyasining 40 foizdan ko'prog'i quyosh energiyasiga to'g'ri keladi. Umuman olganda, 2019 yilda quyosh energiyasidan foydalanadigan elektr energiyasi massivlari tarmoqqa 47 TVt / s .

Germaniya 2019 yilda qariyb 4 GVt quyosh energiyasini qo'shdi, bu 2010 yildagi o'sish davriga qaraganda ancha kam, ammo shunga qaramay, oldingi besh yil ichida bu ko'rsatkich ancha yuqori. Germaniyaning energiya tizimining asosiy ustuni sifatida quyosh energiyasini mustahkam o'rnatish uchun hukumatning yillik kengaytirish maqsadi 2,5 GVt.

Energiya siyosati bo'yicha kuzatuvchilar va qayta tiklanadigan energiya bo'yicha lobbi guruhlari, bu mamlakatning 2030 yilga qadar qayta tiklanadigan energiya hajmini 65 foizga etkazish maqsadiga erishish uchun etarli emas - bu 2017 yilga nisbatan atigi ikki baravar ko'p. Energiya siyosatining Agora Energiewende * ilmiy-tadqiqot markazi taxminiga ko'ra kamida 98 GVt yoki yiliga 5 GVt . Qo'shimcha ma'lumotlarga ko'ra, agar samaradorlikni oshirish bo'yicha ulkan chora-tadbirlar amalga oshirilsa, kengaytirishning zarur darajasi biroz pastroq bo'lishi mumkin.

Yaqin kelajakda o'sishning katta qismi 750 kilovatt (kVt) chegarasidan past bo'lgan kichik loyihalar hisobiga amalga oshiriladi, bu ularni qayta tiklanadigan energiya ta'minoti bo'yicha kim oshdi savdosidan ozod qiladi. Lekin sanoat, dedi qo'llab-quvvatlash bo'yicha nizomning chiqarish hali quvvati 52 GW ham otamga rivojlantirish to'plami edi va juda zarur bo'lgan investitsiyalar off chocke. Hukumat BSW Solar ma'lumotiga ko'ra , 2020 yil birinchi yarmida bu mumkin bo'lgan maksimal quvvatni ishga tushirishdan oldin qopqoqni echib olishni buyurdi .

Fraunhofer ISE ilmiy-tadqiqot institutining ta'kidlashicha, agar Germaniya bir kunning o'zida energiyaga bo'lgan ehtiyojni qayta tiklanadigan energiya bilan to'liq qoplasa, quyosh quvvati 150-200 GVt ga oshishi kerak. 2017 yilda o'rnatilgan 43 GVt, atigi 300 kvadrat kilometr maydonni egallagan yoki binolarga o'rnatilgan yoki ochiq maydonchalarda qurilgan. Agar massivlarning o'rtacha samaradorlik darajasi taxmin qilinadigan darajada oshsa, Germaniyaning uglerod neytral energiya tizimining sig'imi 1000 kvadrat kilometrgacha iste'mol qiladi. Bu mamlakatning barcha aholi punktlari va infratuzilmalar maydonining 2 foiziga yoki binolar joylashgan maydonning 8 foiziga teng. Transport va infratuzilma vazirligi ( BMVI) tomonidan o'tkazilgan tadqiqotga ko'ra ), Germaniyada quyosh energiyasini o'rnatadigan qurilmalar uchun cheklovlarsiz umumiy maydon ochiq maydonlarda qo'shimcha 143 GVt va binolarda 150 GVt quvvat olish imkonini beradi.

Talab qilinadigan vaqtning yuqori qismida soat 12.00 atrofida quyosh energiyasi oqimi tarmoqqa barqarorlashtiruvchi ta'sir ko'rsatadi, ammo ilgari energiya ta'minotida etishmovchilik bo'lganligi sababli ilgari elektr energiyasi etkazib beruvchilar uchun foyda marjasini sezilarli darajada kamaytiradi. Biroq, quyoshli ob-havo va issiq harorat avtomatik ravishda quyosh energiyasini ishlab chiqarishga olib kelmaydi .

Qisqa muddatli davrda ham, peshin atrofida ham, yozda ham uzoq muddatli yuqori rentabellik , qishda va kechada bir -biriga nisbatan past yoki mavjud bo'lmagan ishlab chiqarish bilan qoplanadi, bu qayta tiklanadigan energiya manbalarini kengaytirish uchun ishonchli saqlash texnologiyasi zarurligini ta'kidlaydi. . Fraunhofer ISE ma'lumotlariga ko'ra, Germaniyada quyosh batareyalari yiliga 980 soatiga to'liq quvvat bilan ishlaydilar, bu shamol kuchi etkazib beradigan miqdorning yarmidan kamidir. Tadqiqotchilarning hisob-kitoblariga ko'ra, mamlakatda 1030 to'liq ish soati mavjud, ammo bu hali ham 2016 yilda lignit o'simliklar ishlagan deyarli 6,600 to'liq ish vaqtidan ancha past .

Inqirozga uchragan mahalliy quyosh sanoati yangi kengayish to'lqinlariga umid qilmoqda

The rapid growth of Germany’s solar power capacity - despite the country’s modest potential for harvesting solar energy - had been made possible by its Renewable Energy Act (EEG), introduced in 2000. The EEG gave precedence to renewable energy sources and allowed investors guaranteed remuneration for a 20-year-period. The number of solar panel producers and service companies skyrocketed quickly, as investors rushed to reap the benefits of this large-scale technology support. Especially between 2008 and 2013, Germany saw its solar power capacity increase rapidly from about 6 GW to 36 GW, with annual expansion peaking at more than 8 GW and creating about 150,000 jobs in the country by 2011.

However, after its quick ascent to world leadership within less than a decade, Germany’s solar industry’s faced an even more rapid decline after 2012. Competitors from abroad, especially from China, offered solar panels at a much cheaper rate than German manufacturers, while support rates remained stable regardless of the panels’ country of origin. Consequently, many investors swapped domestic for foreign suppliers to maximise their returns and left the freshly expanded German industry bereft of customers. Due to a parallel drop in guaranteed remuneration, solar expansion fell by 80 percent between 2013 and 2015, while it doubled globally during the same period.

The effects on the German solar power industry were harsh. Many major players, such as Q-Cells, Solon and Conergy - which often had just invested large sums of money to ramp up production - were forced to close down. As a result, the number of jobs plummeted to just over 45,000 in 2016. SolarWorld, once one of the three biggest solar power companies in the world and the last major solar panel producer from Germany, finally succumbed to Chinese competition and filed for insolvency a year later. The industry initially secured protection from Asian competitors through the implementation of trade barriers by the European Commission in 2013, which imposed minimum prices on Chinese imports. But as it did not succeed in keeping European manufacturers healthy, the EU Commission abandoned trade limitations in September 2018.

Many commentators lamented that the support policy effectively meant that German power customers subsidise Chinese producers with whom domestic suppliers could not compete due to higher labour costs and stricter environmental regulation on panel production. Others lauded the combination of German money with Chinese products as a catalyst for cost reduction that helped boost capacity growth and paved the way for the technology’s competitiveness.

As of 2020, the business climate among solar power companies in Germany has squarely bottomed out from its breakdown and reached the highest level in ten years. The industry looks ahead with more confidence, as the introduction of carbon pricing in the buildings sector and the increasing popularity of home batteries are about to substantially increase the panels' value for power users.

Solar power has become the cheapest mode of power generation in Germany, according to research institute Fraunhofer ISE. Depending on the type of installation and the sun's intensity, generating one kilowatt hour (kWh) with solar panels can cost no more than 3.7 eurocents, it says. Costs for equipment and installation, the biggest factor for investors, fell by 75 percent between 2006 and 2017. An analysis by British climate NGO Sandbag found that costs fell so much that new solar (and wind power) installations in German auctions are not only cheaper than new hard coal and gas plants, but also undercut the operation costs of existing fossil power plants.

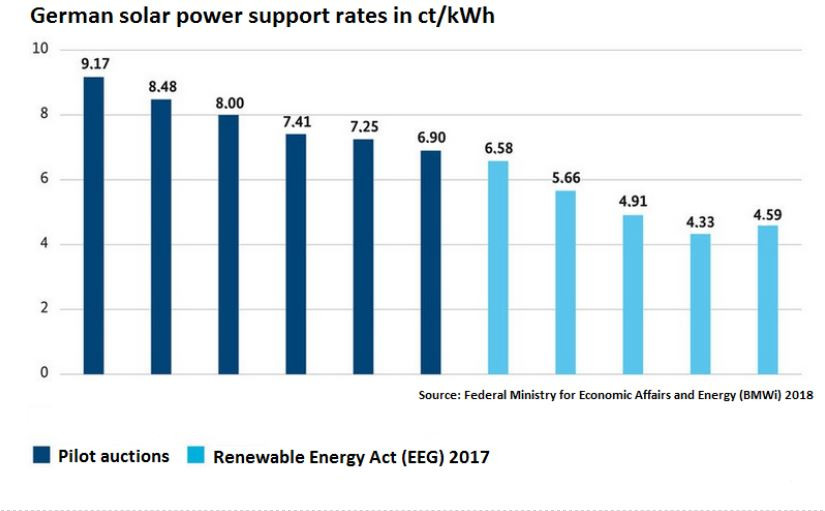

However, support payments for existing and new solar power installations still carry substantial costs for German power customers, amounting to over 10.3 billion euros in 2018 alone, according to the economy and energy ministry (BMWi). Average support for solar power installations in Germany’s February 2018 auction stood at 4.33 cents per kilowatt hour (kWh), compared 4.6 ct/kWh for onshore wind power.

Storage and innovation could bolster German companies

Solar panel manufacturers in Germany have gone through difficult times and the lifting of EU tariffs on Chinese imports is likely to make things even harder for hardware-producing companies. On the other hand, the expected further drop in costs could inject new life in other sectors of the solar power industry. Market observers estimate that the removal of trade barriers will substantially lower systemic solar power costs and lead to a boost in European demand by up to 40 percent in 2019. Solar power companies that offer technical and digital services or who are pressing ahead with development of complementary technologies like home storages could turn out to be the new trade regime’s great beneficiaries.

While German solar power companies struggle to compete with Asian manufacturers, they retain an edge when it comes to research on the modules’ system integration and the implementation of innovative applications. Foreign market leaders are often focussed on large-scale projects that yield high returns but will likely only account for a part of future growth, where small-scale prosumers are expected to play an important role as well.

Companies like Solarwatt or sonnen offer integrated solutions that allow for storing surplus solar energy at home and also sharing or trading it with neighbours and other prosumers around the clock. As prices for home storage technology have fallen sharply over the past years, they are set to benefit from a trend towards self-supply and decentralised production that makes them less reliant on support rates and could soon initiate a new wave of solar power investments in the country.

Although guaranteed support rates have fallen considerably since 2010, the market has picked up again rapidly in 2018. Of the new installations added in the year before, the largest part was mounted on the roofs of private investors. Solar arrays with a capacity rating below 10 kWp account for over two thirds of Germany’s 1.6 million total installations. In the first half of 2018 alone, 35,000 more installations were added by households and small businesses seeking to become more independent of market power prices.

However, falling panel prices that have been a large driver in the latest surge in solar power expansion could soon hit a plateau. This would allow other factors, such as greater productivity, sustainability and flexibility, gain in importance for researchers and investors. Companies like British-German joint venture Oxford PV offer alternatives that challenge the dominant silicon-based solar panels. The company specialises in panels made with the material perovskite, which are believed to have a much greater efficiency potential than silicon models. In 2018, Oxford PV secured funding by the German government to move to large-scale production.

Panelni rivojlantirishdagi kelajakdagi yutuqlardan qat'iy nazar, Germaniya fuqarolari allaqachon quyosh energiyasini qayta tiklanadigan energiya ishlab chiqarishning sevimli shakli sifatida qabul qilmoqdalar va bu texnologiyaning kengayishi ularga eng kam zarar etkazishini ta'kidlamoqda. Aslida, quyosh energiyasi nemislar kelajakda eng muhim energiya manbai bo'lishiga ishonadigan so'rovchi Allensbax tomonidan o'tkazilgan so'rovda birinchi o'rinni egalladi. Respondentlarning sakson foizi quyosh energiyasi etakchilik qilishini va undan ko'prog'ining ulushi 85 foiz bo'lishini kutishdi.